-40%

RARE HISTORIC MASS. 1756 TAX DOCUMENT FR & INDIAN WAR TAX IS LEAD UP TO REV WAR

$ 66

- Description

- Size Guide

Description

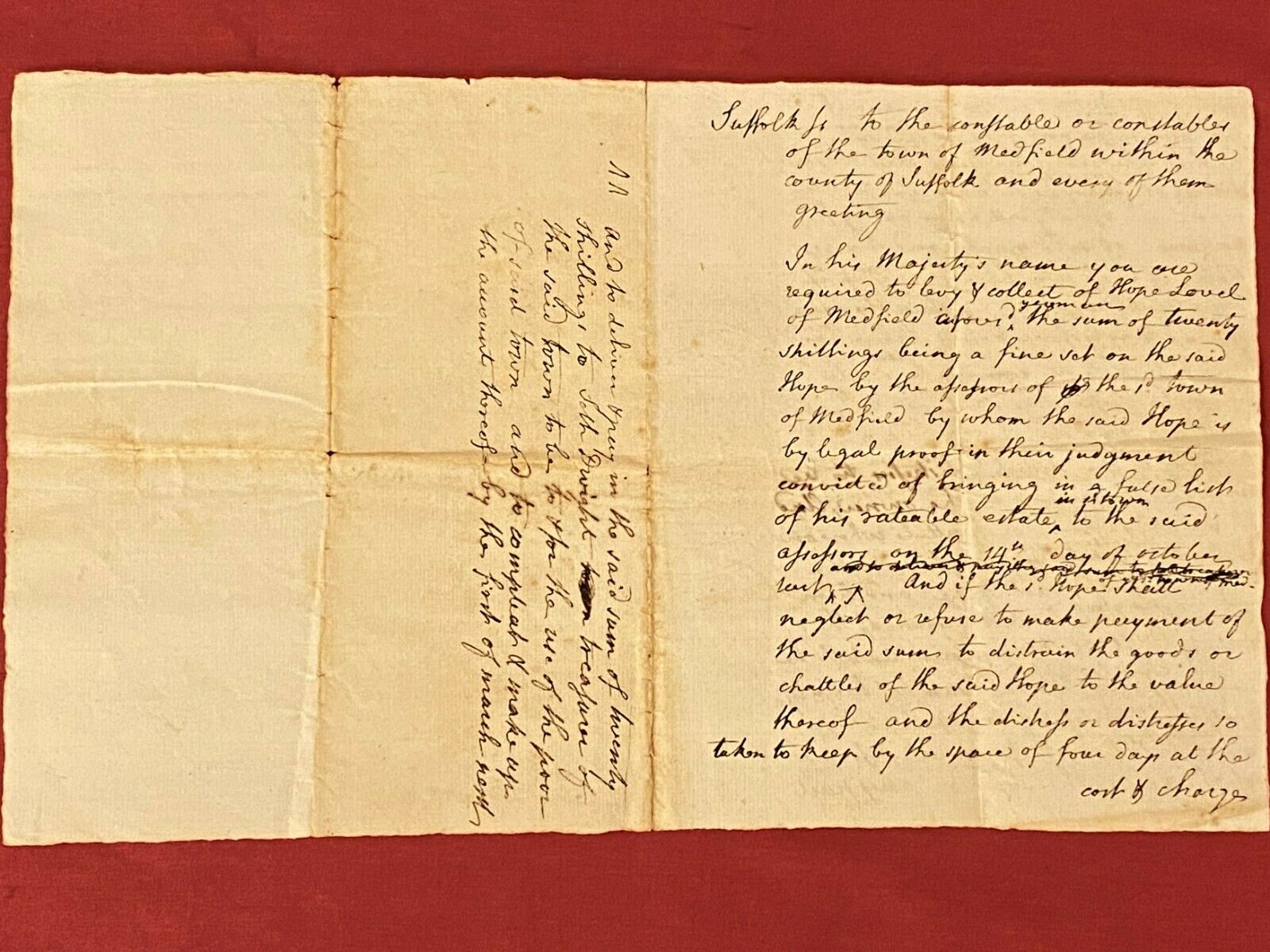

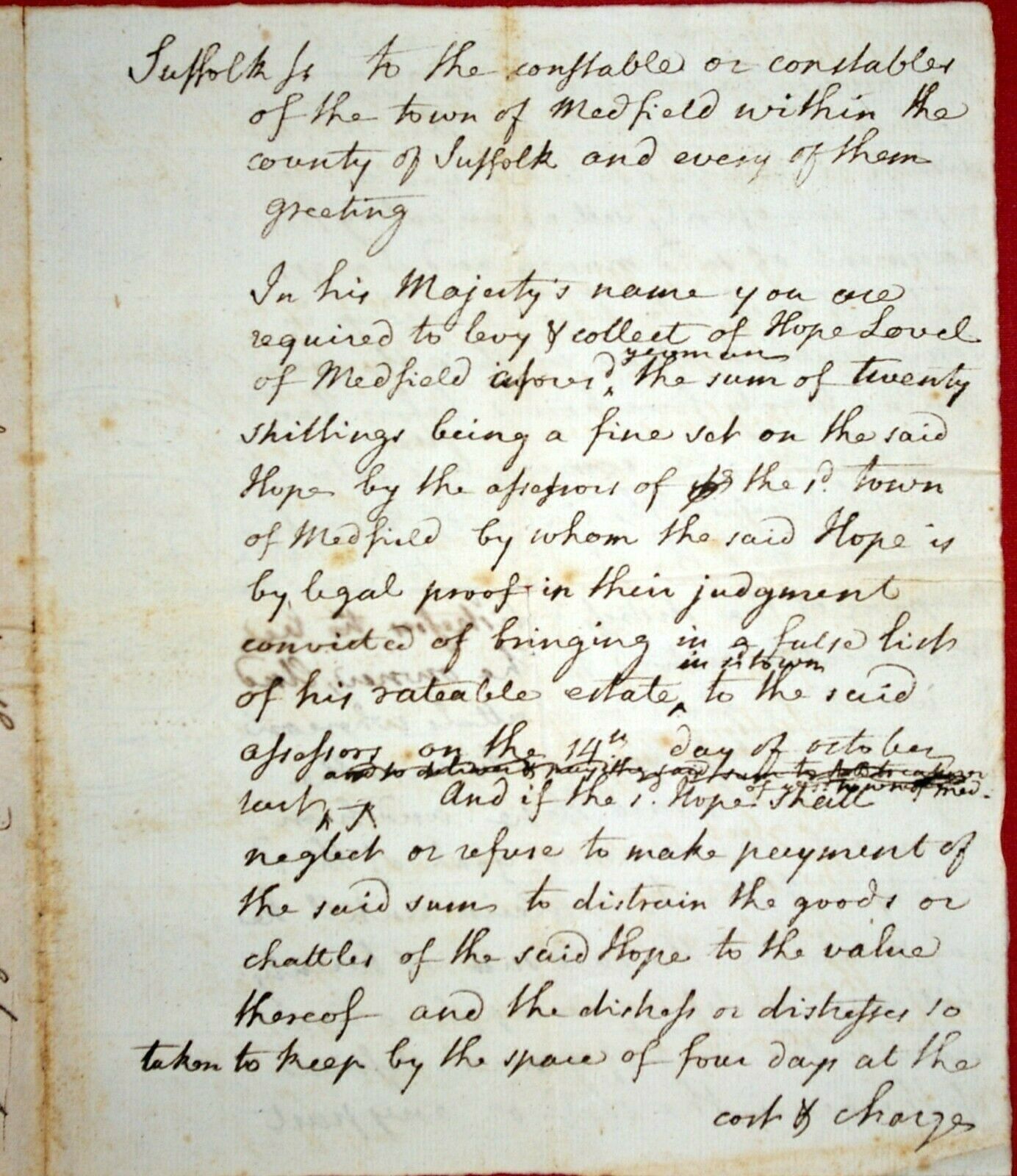

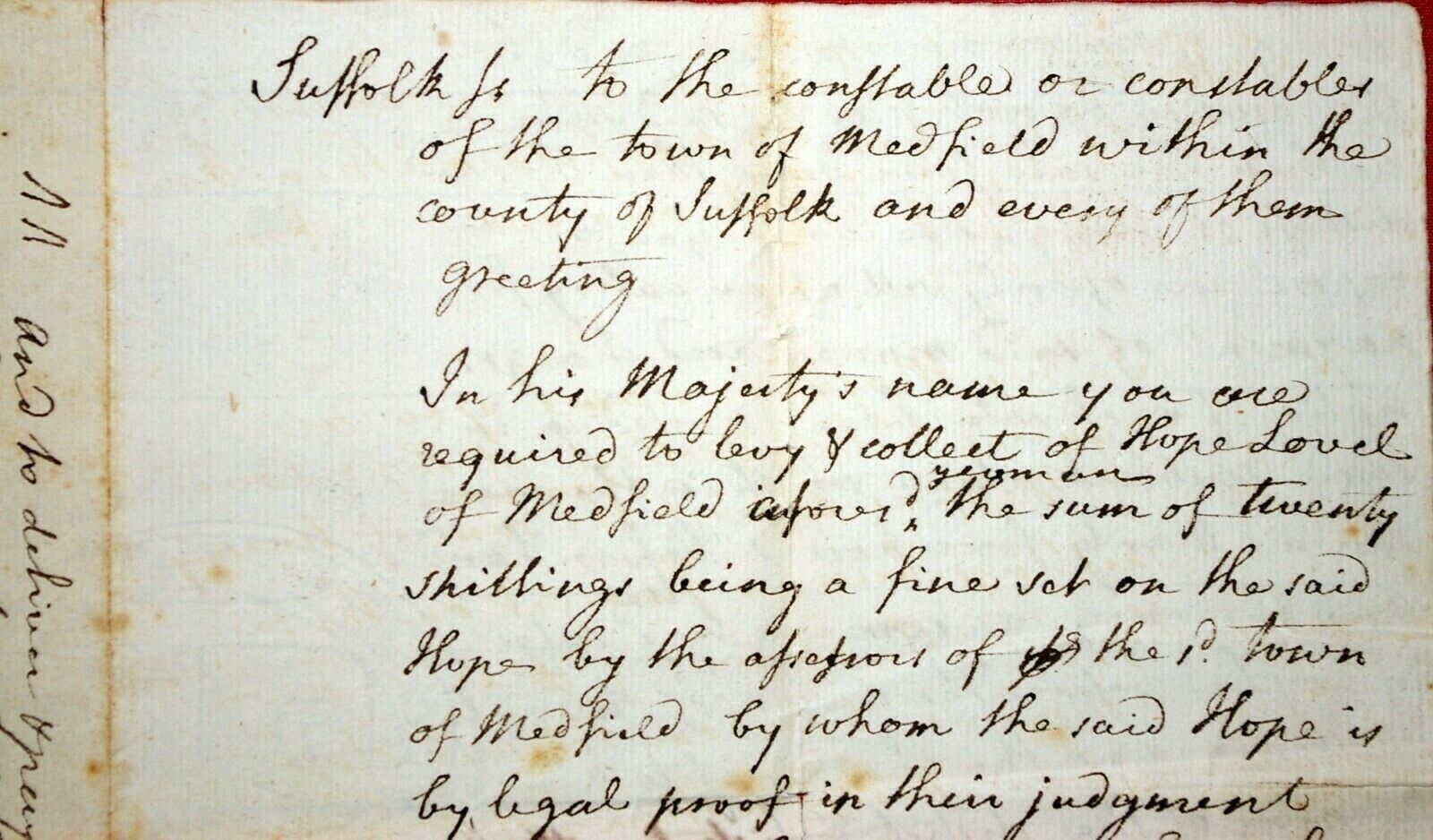

VERY IMPORTANT 1756 TAX DOCUMENT "IN HIS MAJESTY'S NAME", PENALTY FOR NOT ACCURATELY LISTING TAXABLE PROPERTYI have had this document for a number of years. It is 6" x 7 1/2" and is in VG condition with fold lines but otherwise in very nice condition.

This rare 1756 document document levies a tax

"In His Majesty's Name"

against one Hope Lovel of Medfield, Mass. (a few miles outside of Boston) for not accurately reporting his taxable assets. The date of this document, 1756, is very important. There was a heavy financial burden of the French and Indian War (1754 to the Treaty of Paris, 1763) to the British empire in defense of its colonial territory in North America, as well as the larger war on the European continent between England and France. Believing that the colonies owed the Crown for its investment of blood and treasure for the conflect, this heavy debt resulted in a series of taxes levied on the colonies to help replenish the Crown treasury for the financial costs of that prolonged war. In years clearly during and following the war, these taxes included stamp tax, tea tax, etc. At this point in time, 1756, taxes were still complied with by the colonies and as seen in this document, those who did not pay their fair share, who tried to hide the value of their property against levied taxes, were subject to financial penalty. And this document, from a location near Boston, also has historical significance as Boston later became the colonial hotbed of oppostion: to the payment of taxes.

It was the American colonial grievance over taxation

"No Taxation Without Representation"

and other grievances such as the obligation to quarter troops in various communities, limitation on how and where colonial America could trade, etc. that resulted in clashes in Boston and elsewhere, resulting in the Declaration of Independence, July 4, 1776.

Clearly this document, executed in 1756, fining a colonist from Massachusetts for apparently hiding his assets and not reporting the full value of his possessions, is an early example where England sought to collect monies it believed were owed to the Crown, in this case by an individual colonist:

"

In His Majesty's name you are required to levy and collect of Hope Lovel of Medfield the sum of twenty shillngs being a fine set on the said Hope by the assessors of the town by whom the said Hope...is convicted of bringing in a false list of his rateable estate..."

In essence this is a fine levied against Hope Lovel as he failed to accurately identify his taxeable assets. The document goes on to indicate if the 20 shillings is not paid, property owned by Lovel could be taken and sold to cover the 20 shillings; and if there is insufficient goods to sell and make up the 20 shillings,

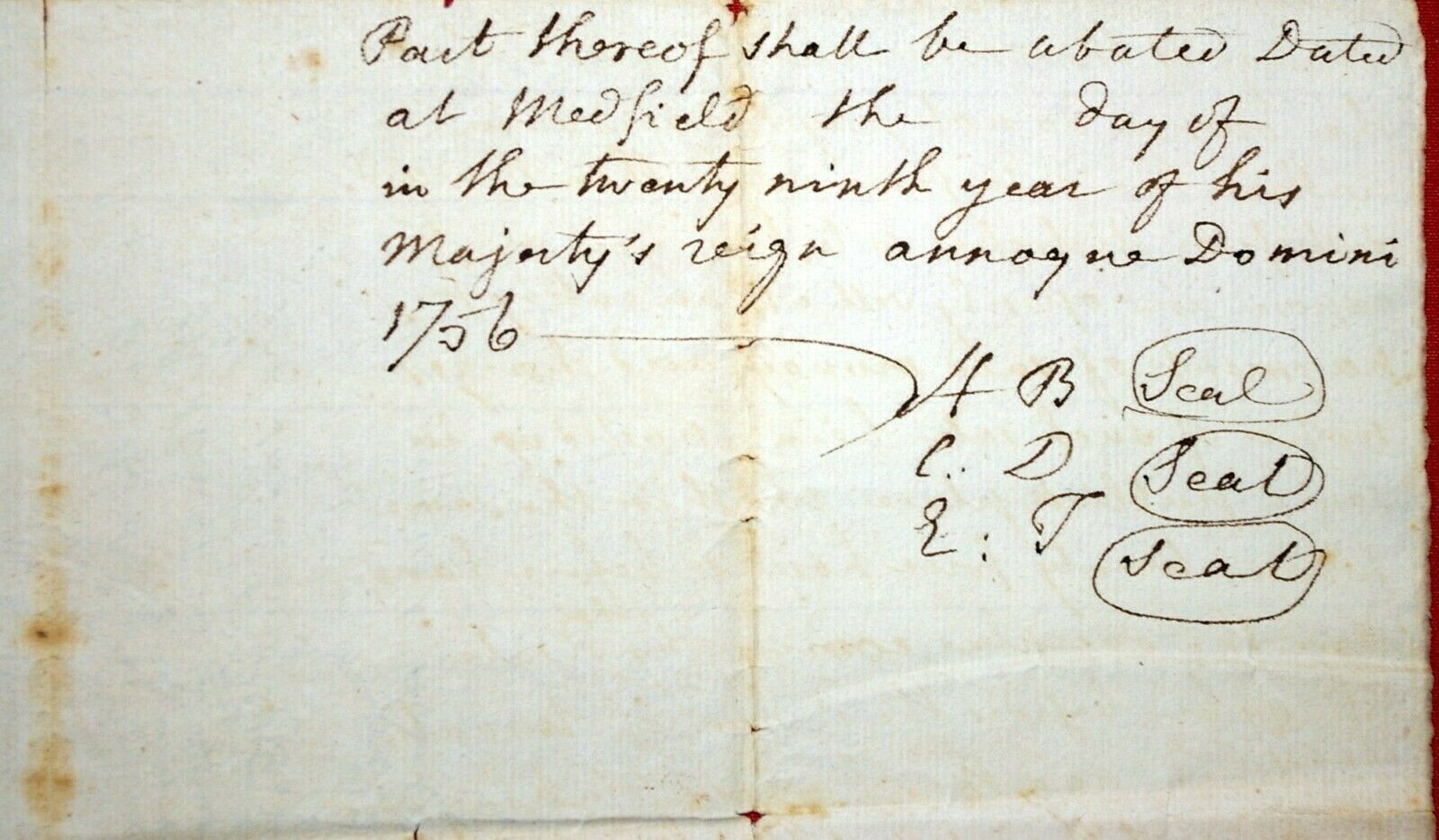

"you are to seize the body of him the said Hope and him commit to the common goal of the county...there to remain until he pay and satisfies the said sum of twenty shillings".

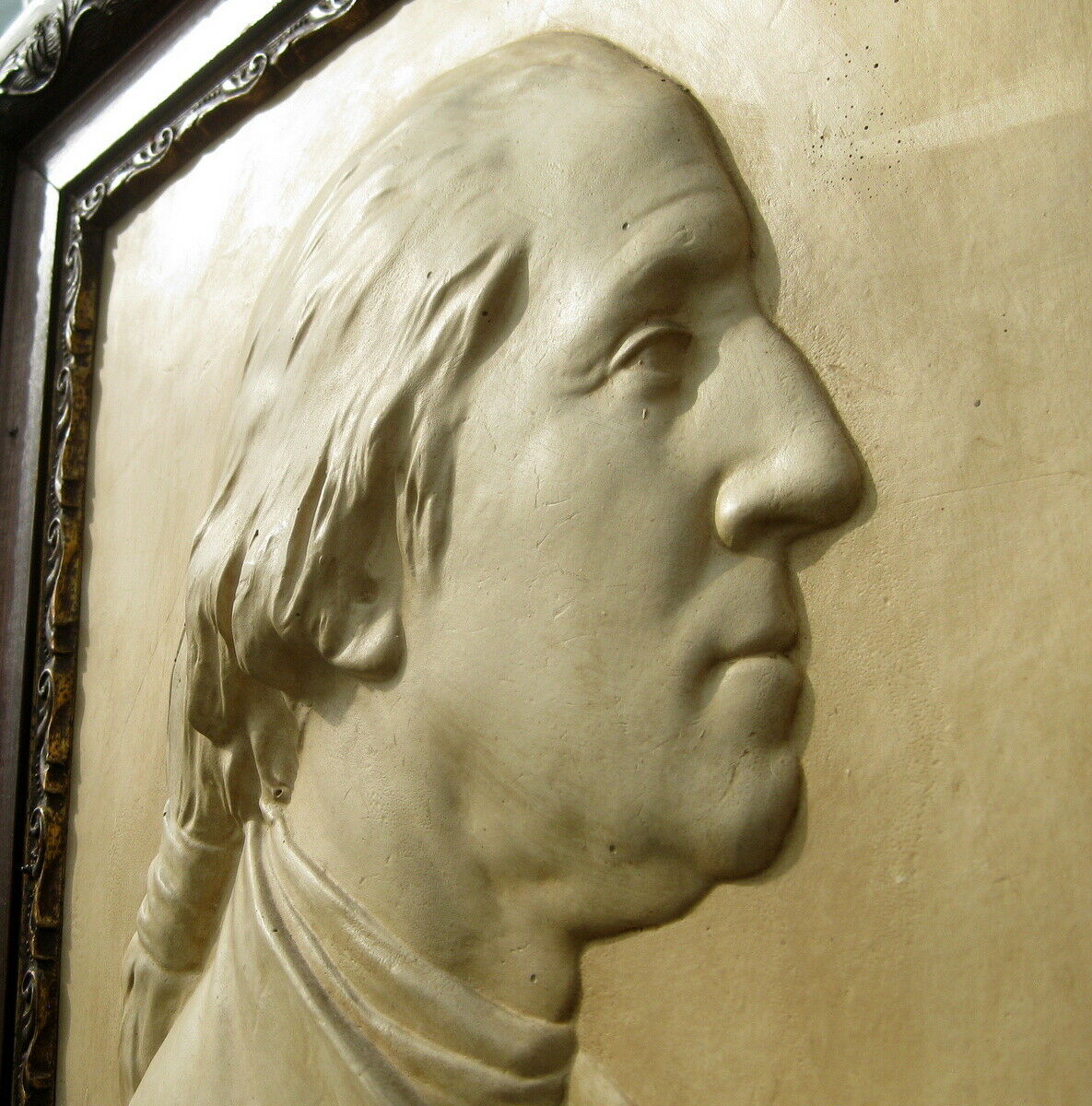

All this done "In His Majesty's name". As the back side of the document indicates this document is in the "29th year of his Majesty's Reign", this document was executed during the reign of George II.

30 day return guarantee as long as the document is returned in the same condition as sent. Mailing cost includes insurance and is based on domestic mailing; international mailing cost is based on destination and mailed through the Ebay Global Shipping Program.

This would make a great addition to a collection of historic documents; in this case it is applicable to two collecting areas: taxes associated with the Crown at the time of the French and Indian War. And a colonial document that can be seen as a direct precursor to growing dissent against the Crown; in this instance, clearly trying to hide taxable property value. Opposition to Crown taxation continued to build until American colonists took up arms against the British government in the colonies.